Click here to view a video that explains the understanding of Annuity basics.

Click here to view a video that explains how to calculate the future value of an ordinary annuity.

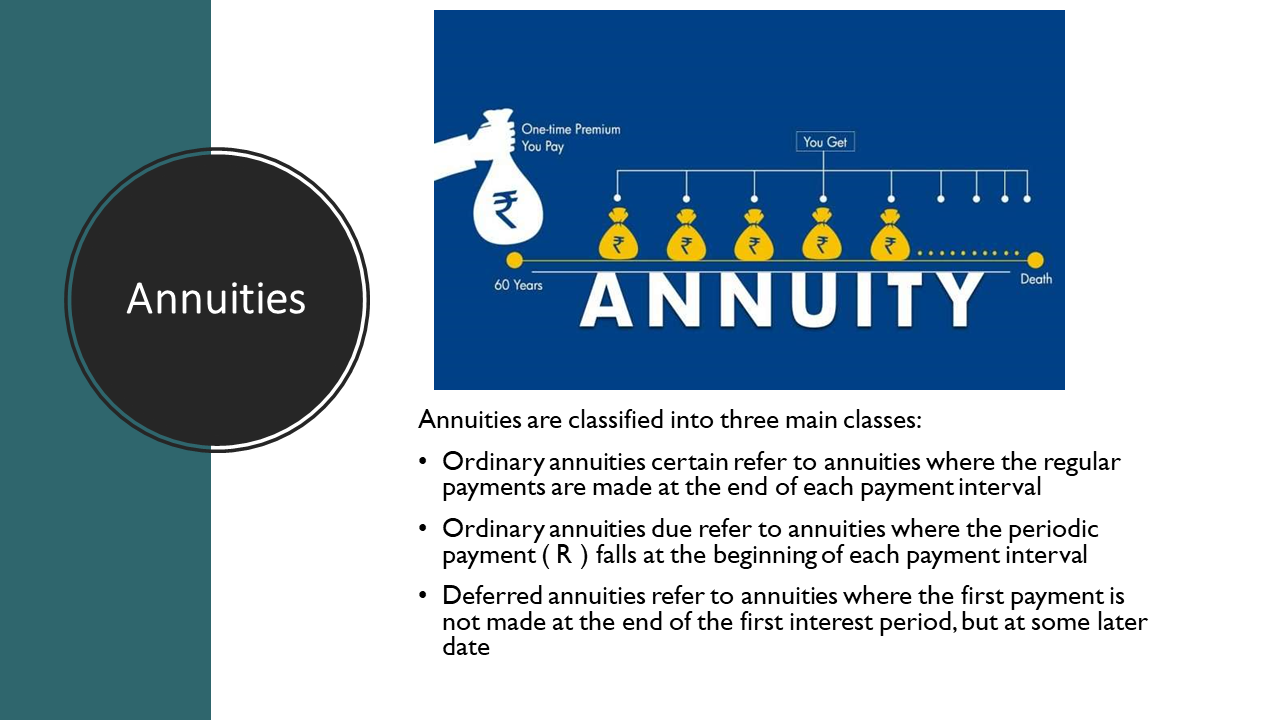

An annuity is a sequence of equal payments made at equal time intervals, such as instalment payments, pensions, insurance premiums, home loan payments, rent, etc. The time between successive payments (R) is called the payment interval, and the time between the first payment and the last payment is called the term of the annuity. The payment interval and the interest period always coincide, which means that, if the interest is compounded monthly, the payments will be monthly.

Ordinary annuities certain:

The regular payments made are at the end of each payment period. To calculate the future value or amount (A) of an ordinary annuity certain, we apply the following formula:

A = R __(1 + i)n - 1

i

To calculate the present value or principal (P) of an ordinary annuity certain, we apply the following formula:

P = R 1 – ( 1 + i)-n

i

Example:

Determine the amount of an annuity certain of R150 per quarter for 3 years if the money is worth 12% compounded quarterly:

A = R (1 + i)n – 1 = 150 (1 + 3% )12 - 1 = 2 128.80 Rands

i 3%

Ordinary annuities due:

If the periodic payments fall at the beginning of each payment period (pay in advance), the following formulae apply:

To calculate the amount or future value:

A = R [ (1 + i) n - 1 ] [ 1 + i ]

i

To calculate the present value or principal:

R = ______ Ai _____

[(1+i)n -1] [1 + i]

Example:

An investment of R200 is made at the beginning of a year for 10 years. If interest is 12%, how much will the investment be worth at the end of 10 years?

A = R [ (1 + i ) n - 1 ] [ 1 + i ] = 200 [ (1 + 12% )10 - 1 ] [ 1 + 12% ] = 3 930.92 Rand

i 12%