The Cashflow Statement is the third major financial statement. Income Statements show the passing relationship between money that changes hands, while the Cashflow Statement focuses on changes in liquidity.

A Cashflow states the sources and uses of funds and explains the changes in cash and cash equivalents over the period of accounts.

Cashflows can be done using one of two methods, the direct method or the indirect method. Cashflow statements do not include the amounts recorded from credit, only cash.

Direct Method

Let us start by explaining the direct method.

The direct method directly shows receipts from customers and payments to suppliers. Let’s look at the example below:

The direct method cashflow statement is fairly self-explanatory.

Indirect Method

Let us now look at the indirect method. This method is used more frequently and is essentially the reversing out of non-cash items from the net-income. The indirect cashflow looks at the three components by which cash enters and leaves a company: core operations, investing and financing.

Operations:

The operations component reflects how much cash is generated from a company’s products or services. Generally speaking, changes made in cash, accounts receivable (receipts from customers), depreciation, inventory, and accounts payable (payments to suppliers and employees) are reflected in cash from operations.

Cashflow is calculated by making certain adjustments to net income, by subtracting or adding differences in revenue, expenses and credit transactions resulting from transactions that occur from one period to the next. These adjustments are made because non-cash items are calculated into net income (from the Income Statement) and total assets and liabilities (from the Balance Sheet).

Examples of adjustments that are made to calculate cashflow are:

- Depreciation is added back into net income. (This is because depreciation is an amount deducted from the total value of an asset and is not an actual cash expense).

- Changes in accounts receivable from one accounting period to the next are reflected. If accounts receivable decreases, then more cash have entered the company (more people are paying off their credit) and this is then added to net income. If accounts receivable increases then this is deducted from net income, because these amounts are not cash, but credit.

- If inventory increases, then more money has been spent. If the inventory was purchased with cash, the increase in the value of the inventory is deducted from net income. A decrease in inventory implies that more cash is coming in and this would therefore be added to net income. However, if inventory was purchased on credit, an increase in accounts payable would occur and the increase in the amount would be added to income.

- The same logic holds true for salaries payable, taxes payable and prepaid insurance. If something has been paid off, then the difference in the value owed from one year to the next has to be deducted from the net income. If there is an amount that is still owed, then this would reflect as in increase in the net income.

Investing:

Investing activities are the acquisition and disposal of non-current assets and investments not included in cash equivalents. When an investment is made, this is a “cash-out “item. When a company divests of an asset, this is a “cash-in” item.

Financing:

Financing activities result changes in the size and composition of the organisation’s capital and borrowings.

Examples: When capital is raised, this is a “cash-in” item. When dividends are paid, this is a “cash-out” item. If bonds are issued, this is a “cash-in” item, however if interest is paid to bondholders, this is a “cash-out” item.

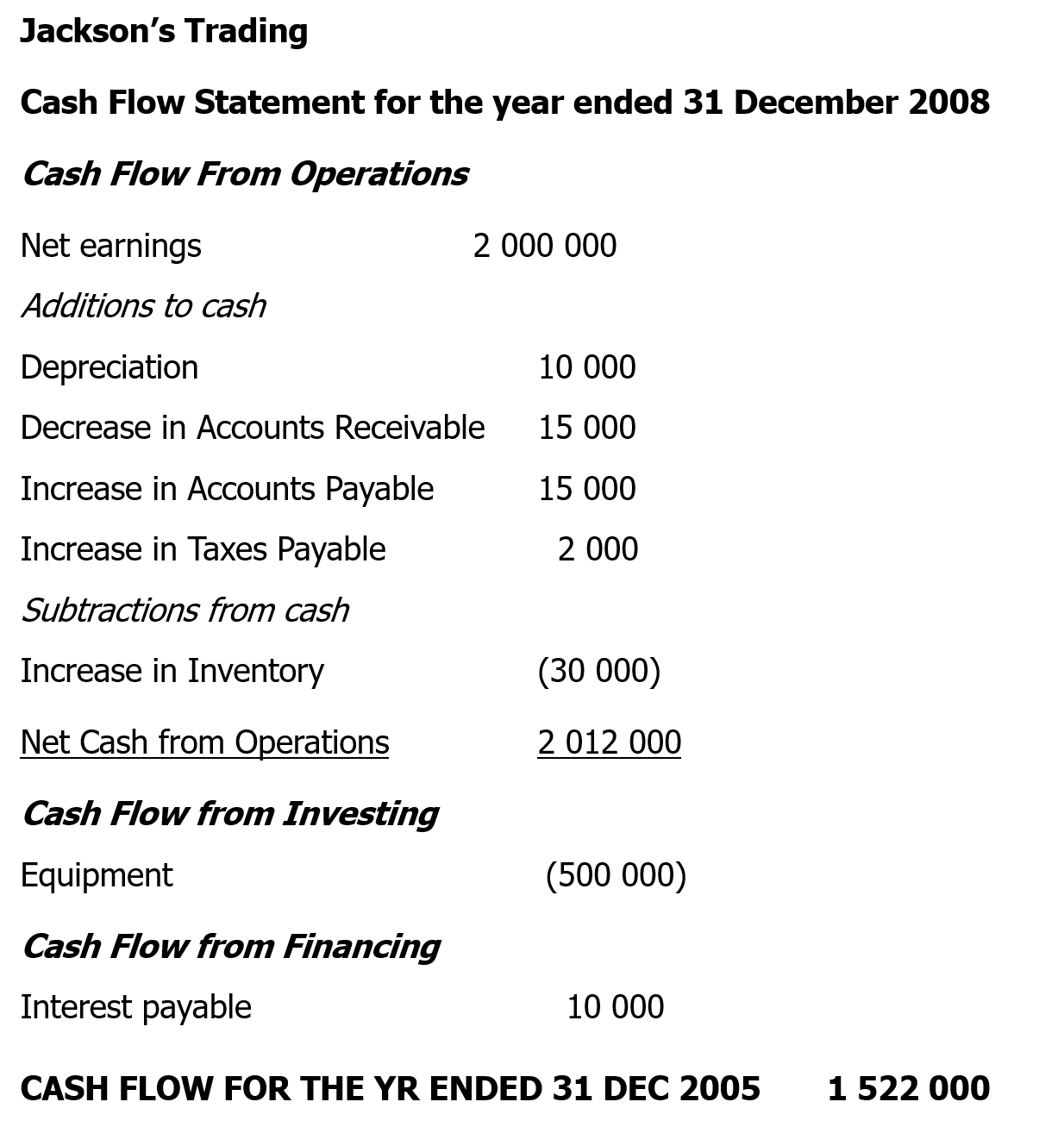

The following example is an illustration of a basic cashflow statement using the indirect method.

Looking at the above example, the bulk of the positive cashflow stemmed from operations, which is a good sign for investors as this means there is enough money to buy new inventory. The purchasing of new equipment is a sign of growth, while cash is available to pay any loans.

Not all cashflow statements exhibit a positive cashflow. However, a negative cash flow is not always a bad thing if, for example, the company is undergoing an expansion.

The Cashflow statement reveals the following:

- Cash earnings

- How the organisation is utilising its funds

- How the organisation is being financed

- Any need for outside financing

- The ability of the organisation to obtain outside financing

- The organisation’s investments or divestments

- The organisation’s ability to generate future cash flows

- The organisation’s ability to meet its obligations

Cashflow, in summary, is essentially a key indicator of the organisation’s health.

Now that you have an understanding of Cashflow Statements, let’s do some activities using other examples of Cashflow Statements. Ultimately, you will need to be able to interpret your own organisation’s Cashflow Statements.

If you understand the concept of a Cashflow Statement, you should not be afraid to tackle any kind of Cashflow Statement, no matter how complicated.

The layout of a Cashflow Statement will follow the same basic structure (with some variations), but there may be some things in the Cashflow Statement that you have not come across before.

Click here to view a video that explains about the Cashflow Statement.

Lecturer Broadcast

Click here to learn more about the Cashflow Statement.

Klik hier om meer te leer oor die formaat van die Kontantvloeistaat.