Variable costs and fixed costs are the two main costs a company has when producing goods and services. A variable cost varies with the amount produced, while a fixed cost remains the same no matter how much output a company produces.

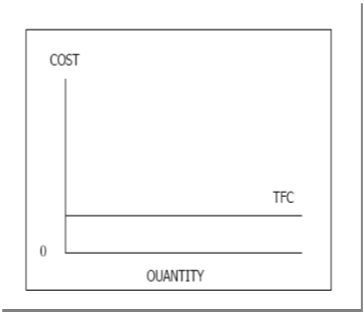

Fixed Cost

Fixed costs are those costs that will stay fairly constant within a period of time like a month or a year even if no production or sales are generated.

Typical fixed costs are rent of building or interest on a bond, salaries of managers, hire of equipment and depreciation on equipment.

The rent of the office will stay the same, even if no clients are seen or no income is generated.

The behaviour of fixed cost could be illustrated as follows:

Although fixed cost is fixed even if no sales are done, fixed cost per unit decreases with an increase in production.

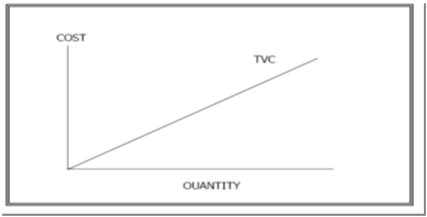

Variable Cost

The total variable cost will vary (increase or decrease) proportionally with the quantity manufactured or used.

Typical variable costs are materials, direct labour, water and electricity, etc.

The behaviour of total variable cost could be illustrated as follows:

Although the total variable cost varies if production increases or decreases, the variable cost per unit stays the same for different levels of manufacturing or sales.

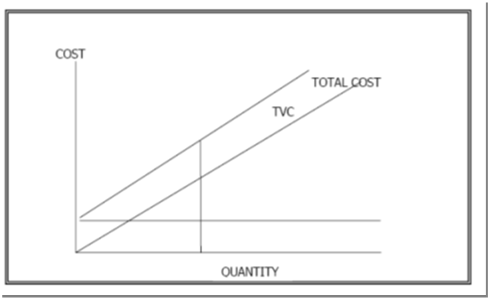

Total Cost

Total cost is simply the fixed cost and variable cost added together.

The behaviour of total cost could be illustrated as follows:

Note that at zero production the variable cost is zero, but the fixed cost must still be paid. As production increases, the variable cost must be added to the fixed cost to give you the total cost.

Click here to view a video that explains the difference between fixed, variable and total costs.