According to the SA National Credit Regulator (NCR), we are edging closer to R18-billion in credit card and store card debt in serious arrears (120+ days). Add to this that 40% of our 27.5 million credit-active consumers have bad debt, and it’s not hard to see why responsible credit card use is so important. And it is possible if you apply these guidelines.

What Credit Card Debt Really Cost You

Research by Old Mutual shows that 56% of South African credit card holders pay the minimum instalment, and only 16% pay their balance in full at month-end. If you are paying the minimum instalment only and continually spending on your card, you are probably slipping deeper and deeper into debt. If you have a credit card or you are in the market for one, make sure you know what interest and charges you are paying, the bank's billing cycle and interest-free period, as well as the minimum instalment.

Before you enter into a credit agreement, the deciding factor for you should be the interest rate the bank is going to charge you. Today, the maximum interest that you can be charged on a credit card is 17.75% a year (the formula, as per regulations, is the repo rate plus 14%). [In February 2020 it was 20.5% - this was prior to two repo rate cuts by the Reserve Bank.] But some banks offer their best customers less than the prime rate, which is currently 7.75%. If you have a good credit score, you should negotiate with potential creditors for a good rate.

Example of Credit Card Interest Rates

Assuming you owe your bank R15,000 on your credit card, and you're being charged interest at 20.5%, if you pay 10% of the outstanding balance every month for 12 consecutive months, you will pay the bank R2,008 in interest over the year. This is before fees, such as monthly admin, credit life insurance, and other fees.

Although paying the minimum can be a relief when you are going through a rough patch, it is not what you want to do over an extended period, as it can cost you a lot. The best way to manage your credit card is to pay off all your purchases each month at the end of the interest-free period, and thus pay no interest to your bank.

Example of Financial Impact if you Only Pay Minimum Due on Credit Card:

Assume you spend R15,000 on your credit card and you are charged interest at the maximum of 20.5%. If you were to pay the minimum of 2.5% a month for one year without making any further purchases, you would have paid less than R1,000 of the capital outstanding over the course of a year, and would still owe the bank R14,039.

If you could pay 10% of the outstanding balance back each month, you would at the end of the year owe only R5,903.

After three years of repaying the minimum of 2.5%, you will have made payments to the bank of R12,433 including a massive R8,332 in interest. You would still owe R12,227 on your card.

But if you are paying 10%, after two years you will be owing only R2,286 and you will have made payments of R16,448 including R2,752 of interest.

Paying the minimum instalment is not advisable and should be a last resort.

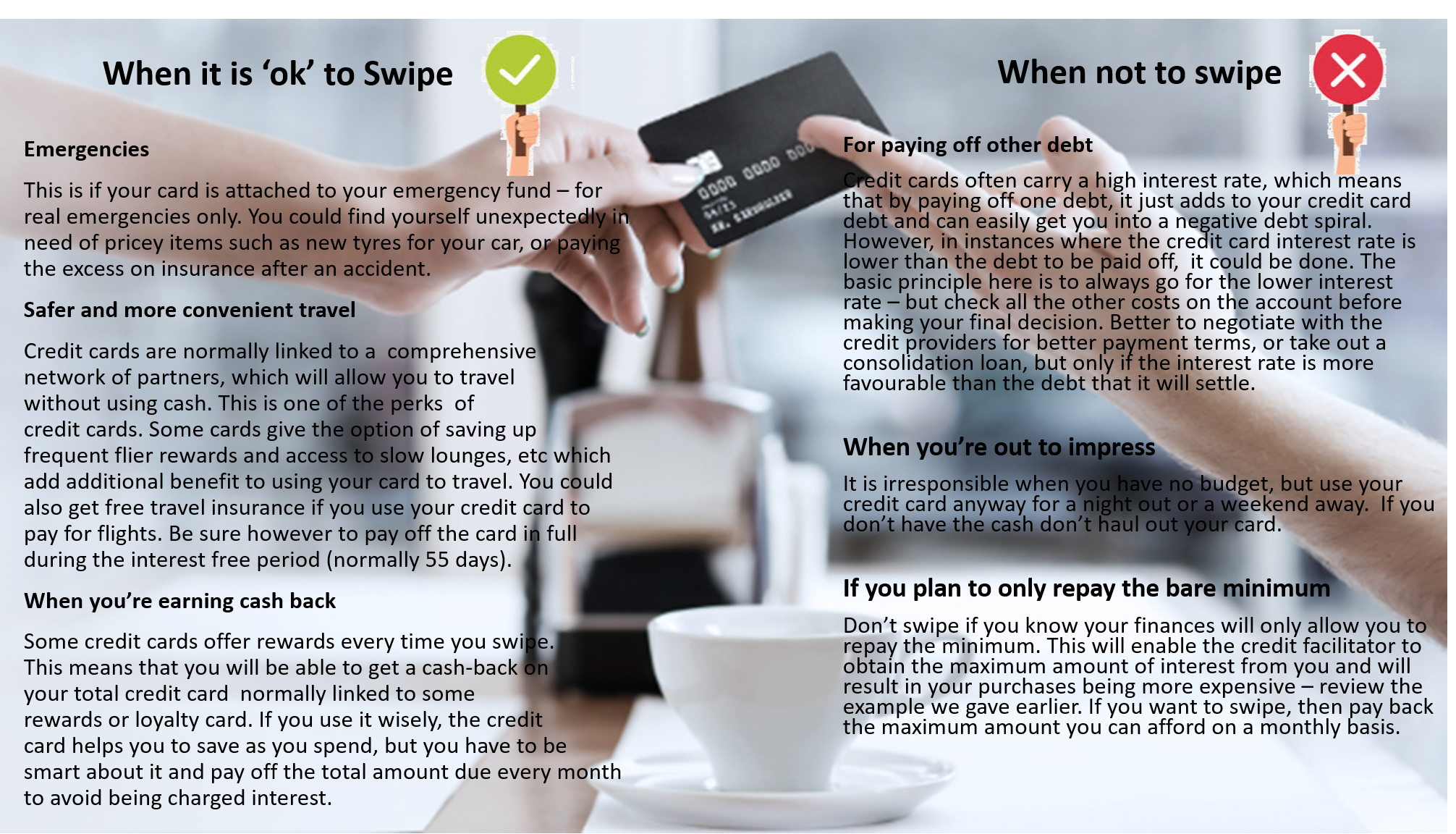

When to Use your Credit Card

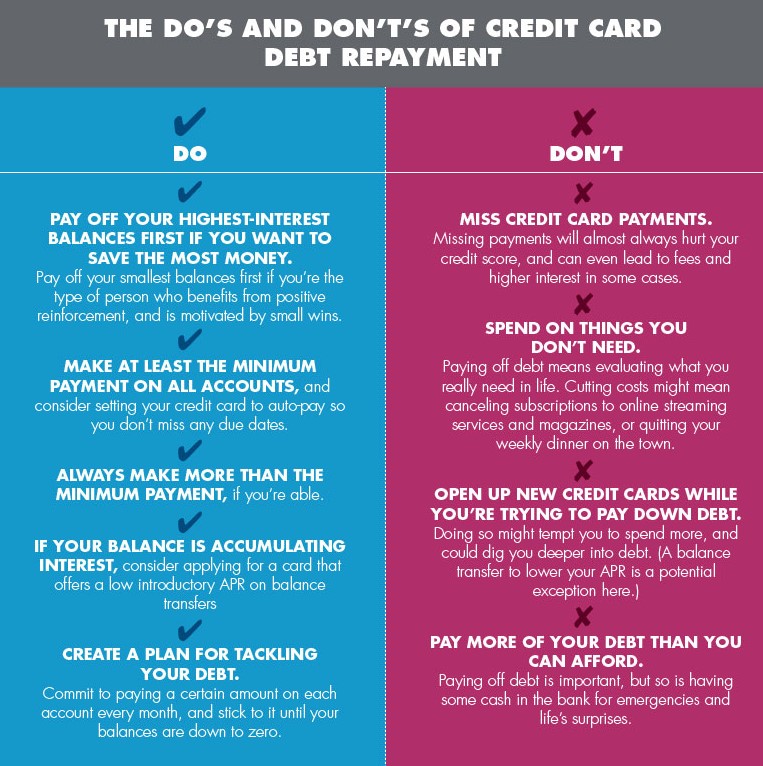

Paying of Your Credit Card