As you know by now, equity is not only influenced by capital injections by the owners, but also by the profit or loss made by the business. This profit or loss is accounted for by means of income and expenditure transactions. It would be impractical to record all these transactions under equity in the balance sheet; therefore, a separate statement, called the income statement is used.

The income statement is also prepared from the trial balance (which has balance sheet as well as income statement balances). If the income statement shows a profit, equity increases, if the income statement shows a loss, equity decreases.

While the balance sheet reflects the financial position of the business at a given point in time, the income statements show what happened over a period time, e.g. one year.

- An asset (balance sheet item), which was sold during the year, will not be reflected on the balance sheet.

- All rent payments (income statement item) for each month of the year will be included in the income statement.

Only the result of the income statement, that is profit or loss, will be shown under equity in the balance sheet. Different formats of income statements are used for retail and manufacturing concerns.

The basic income statement will always contain the following elements:

- Income (sales, turnover, other income)

- Expenses directly related to income

- Indirect expenses such as finance charges and income tax

- Distribution to owners (dividends)

Income minus direct expenses is known as "Gross income". Gross income minus indirect expenses is known as "Operating income". The amount after finance charges and taxes belongs to the owner and could either be paid out as dividends or held back as retained earnings.

Income could be from the sale of goods as well as services. Income is always reflected nett of VAT and returned goods. Other income normally consists of:

- Interest received

- Profit on sale of assets

- Profit on sale of investments

Income reflects cash as well as credit sales. (The money owed to the business for credit sales is reflected on the balance sheet as debtors).

The income statement is prepared for a period, normally the business' financial year. An income statement for the year ended 28 February 1998 will show, for example, sales for the whole year, not just the day 28 February.

- Cost of sales consists of those costs directly related to sales.

- Cost of sales for a retail company consists of the cost price of the goods purchased for resale.

- Cost of sales for a manufacturing company consists of the cost of material and labour of actual goods sold.

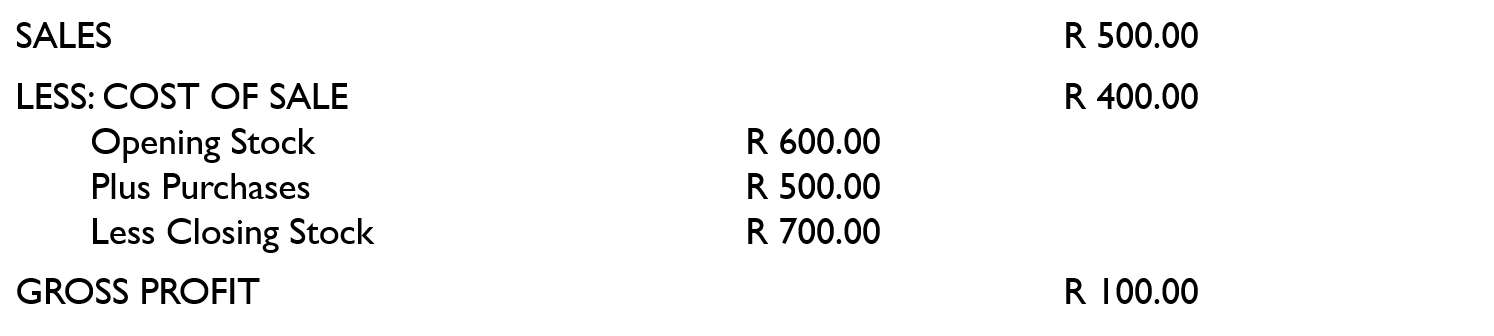

The Gross Profit for a retail business is calculated as follows:

Gross income less indirect costs are known as operating income.

Indirect costs are also called operating expenses.

The following are typical operating expenses:

- Advertising

- Audit fees

- Bank charges

- Accounting fees

- Depreciation

- Entertainment

- Insurance

- Legal fees

- Motor vehicle expense

- Rent of offices

- Rent of machinery

- Postage

- Repairs and maintenance

- Salaries and wages

- Stationery and printing

- Telephone and fax

- Travelling expenses

- Water and electricity

The amount of operating income should be enough to provide for finance charges, income tax and dividends. If not, the enterprise is making a loss.

Any portion (0%-100%) of the amount after tax may be distributed as dividends to the owners.

Any portion not paid out as dividends increases equity on the balance sheet in the form of retained earnings.