In order to analyse the financial information of this unit, we need to look at the calculations of simple and compound interest.

Click here to view a video that explains Simple vs. Compound Interest.

Click here to view a video that explains Simple vs. Compound Interest Whiteboard.

Interest is the cost of money. When money is borrowed, the cost involved in using the money is that the borrower will pay back more than the amount that was borrowed. This is true for a personal loan as it is for an investor who borrows capital. Interest is charged for all kinds of ‘charges’ including loans, hire purchase, rental, lease agreements, credit cards, bank overdrafts, and even in case of late payments of accounts.

The capital on which the interest is calculated at the beginning of the transaction is called the principal (P) or present value (PV).

The rate of interest (r) is that percentage of the principle that is to be paid for each unit of time and is expressed as a percentage per year.

The time period (t) is the period for which the money is borrowed and is expressed in years or a fraction of a year.

The amount to be paid at the end of the term, that is, the principle plus the interest is referred to as the amount (A), or the future value (FV).

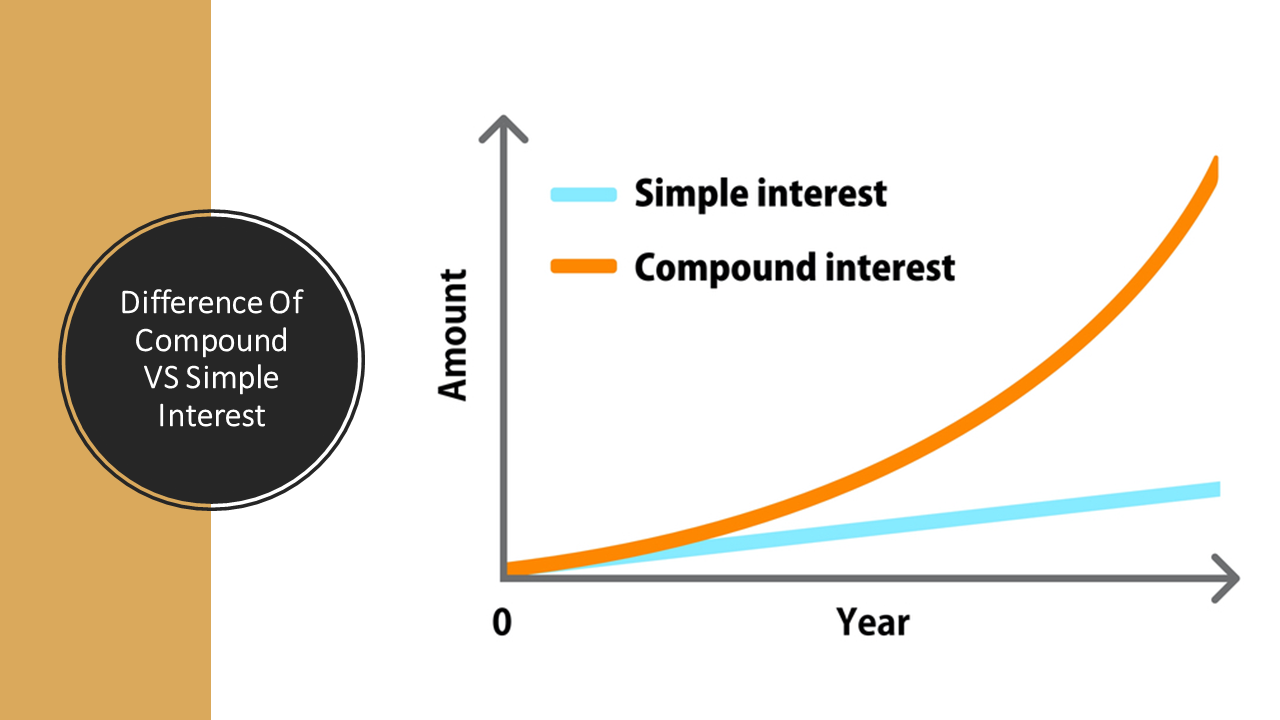

Interest can be calculated on the principal sum as:

- Simple interest, or

- Compound interest

Simple Interest

When simple interest calculations are done, interest is calculated on the principal sum only at the end of a specified period, such as at the end of a year. That means the interest is not available before the end of the term, and the interest is not added to the principal to earn interest on interest.

The standard formulae for calculating simple interest are:

I = Prt

A = P ( 1 + rt )

A = P + I

Where:

I = Amount of interest

P = Principal

A = Amount r = Interest rate per annum expressed as a decimal

t = Time in years or a portion of a year

r = Interest rate per annum expressed as a decimal

t = Time in years or a portion of a year

Example:

See forward Contract deal in the previous example for “B Bank”.

“B Bank” will make an investment with “C Bank” in the amount of R 82 500

(R8,25 x $10 000), for 3 months (90 days) at 7% interest per year.

A = P (1 + rt)

A = 82 500 ( 1 + (0,07 x 90/365)

= 82 500 (1,0173)

= R 83 924

The interest earned over the 3-month period is R 83 924 less R 82 500 = R 1 424.

“B Bank” uses this to pay “A” his R 83 000 (R 8,30 x $ 10 000) and keep the profit. “B Bank”.

Then uses the $ 10 000 for further financial deals.

Compound Interest

When interest is not paid out but is continuously added to the principal, the principal is continuously increasing and we say the interest is compound. This means that the interest calculated in period 1 on the principal amount is added to the principal amount so that the interest calculated in period 2 is calculated on the increased balance. It can therefore be said that compound interest calculates ‘interest in interest’. Compound interest will therefore be more than simple interest, even if the percentage of interest is the same.

Interest can be compounded once a year, semi-annually, quarterly, monthly or even daily. The time period, which is normally quoted as a yearly rate, should be adjusted to the number of interest periods per transaction. For example, if the interest is compounded quarterly, and the time period is 5 years, then the number of interest-compounding periods

(n) is 5 x 4 = 20

To obtain the period rate (i) from the yearly rate (r), the average rate per period method is followed: for example, if the annual rate is 6% compounded quarterly, the period rate is taken to be 6/4 = 1.5%.

N = number of years x number of compounding periods per year

I = annual rate / no. of periods per year

The standard formulae for calculating compound interest are:

A = P (1 + i)n

I = (A/P)1/n – 1

T = __log A/P__

log (1 + i)

Where:

A = Amount or future value

P = Principal or present value

i = Interest rate per period within a year expressed as a decimal

n = number of times per year interest must be calculated

Note: Doing compound interest calculations will require the use of the ‘power’ key on the calculator, which will be marked as either xy or yx, the ‘root’ key, which is usually marked as √, and the ‘log’ key.

Example:

Simon lends R1 000 to Thandi. At a rate of 15% per annum calculated monthly, the amount she must repay at the end of 2 years is as follows:

The interest rate of 15% is the interest that is charged for the year. However, if the interest is to be calculated monthly, then the annual interest rate (15%) must be converted to a monthly interest rate by dividing by 12:

i = 15%/12 = 1,25%

The 2-year period should change to n = 12 x 2 = 24

A = 1 000 (1 + 1,25%)24 = 1 000 (1,0125)24 = R 1 347.35

Amount of interest paid: R1 347.35 – R 1 000.00 = R 347.35

Compound interest is used in mortgage loans and hire purchases and if we need to repay the loan over a period of time, the following formula will apply:

R = P _____i_______

[1-(1+i)-n]

Example:

Lerato successfully completed her studies and found a job as an IT technician. She wanted to buy a new Chevrolet Aveo. She needed to obtain financing from the bank to the value of R90 000 to buy the vehicle. The monthly compounded interest rate is 12%. She will amortize the loan by monthly payments over a period of 4 years.

R = 90 000 [0.12/12]

[1 – (1+.12/12)-48]

= 90 000(0.02633835)

= R2370.05