Introduction

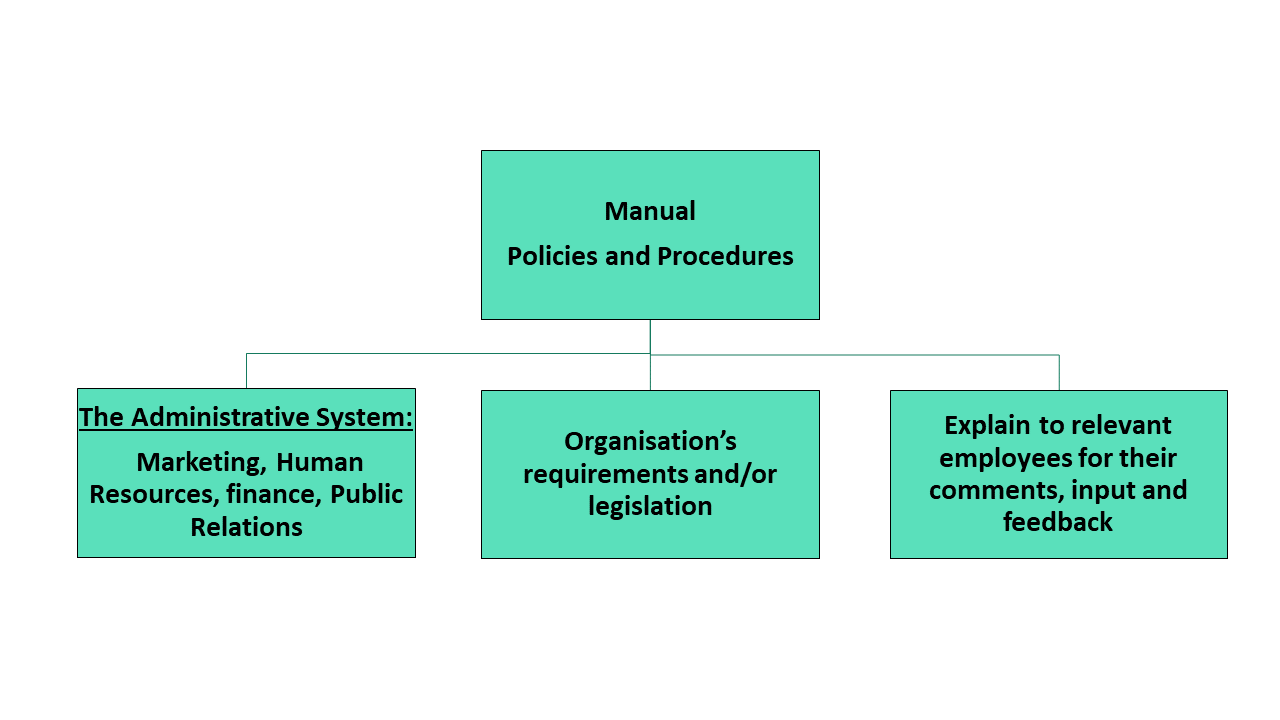

To write a policy and procedure for a specific organisation requires that analysis if the organisation is concluded, as to identify the necessary administrative systems and the information that has to be included. Only four of the previously identified systems will be discussed in detail (Marketing, Human Resources, Finance and Public Relations.

For every one of the four systems, the following will be described:

- Which administrative system are discussed, focussing on the purpose and function of that specific system,

- The organisation requirements and/or legislation must be taken into consideration when policy and procedures are compiled.

- Explaining this to relevant employees, in order to get feedback and input from them, with the purpose to make the policy and procedures relevant, valid and practical.

Once these three aspects have been included, a manual will be written that can incorporate all this information.

For all systems certain legislative boundaries are applicable. All are underlined by The Constitution of South Africa. To include a diverse perspective on different organisations, examples from different kinds of organisations and companies will be discussed. External information and internal information are included in policies and procedures to ensure that all needs are addressed and included.

Swot Analysis

A SWOT analysis is a widely used tool to determine the administrative systems necessary in the organization.

Click here to view a video that explains ultra-niche crops business plan SWOT analysis.

Click here to view a video that explains business planning SWOT.

The purpose of the organization, its origin, the number of employees, the number of products/serviced to be rendered and the type of products/services rendered, will play a role in determining the size of each department. An organization that has 1000 employees will have a different kind of Human Resource Department from an organization employing 300 people. An investigation into the strengths, weaknesses, opportunities and threats will clarify the needs of each department. Internal restructuring, skills development needs and possible outsourcing can be negotiated to maximize the optimal functioning of the organization.

Example of a SWOT analysis for a fictional electric car manufacturer:

|

Strengths

|

Weaknesses

|

|

Opportunities

|

Threats

|

Marketing

The goal of the Marketing Department includes communicating the value of the product or service to customers or consumers, for the purpose of selling that product or service.

For this purpose, the marketing department needs access to the strategies formulated by top management, characteristics of products/services and logistical information in this regard. Clients/potential clients and competitors in the market must also be analysed.

Specific legislation pertaining to marketing can include organisation specific legislation (see example) or the Marketing of Agricultural Products Amendment Act (no 52 of 2001)

For more specific Acts: www.gov.za can be visited.

Click here to view a video that explains the National Agricultural Marketing Council profile.

A policy for marketing may include marketing to promote the responsible use of alcohol. Procedures to support this can be described as follows:

Click here to view a handout that explains an example policy and procedure for marketing.

Human Resources

The goal of the Human Resource Department includes the management of the employees. The employee requirements, such as job descriptions, salary scales, training, skills development and so forth forms part of the Human Resource function. Trends regarding the labour force and salaries received in other organisations will provide guidelines.

Specific legislation pertaining to human resources includes the Basic Conditions of Employment Act and the Labor Relations Act. A policy for human resources may include the policy formulated with regards to taking Sick Leave.

Procedures to support this policy can be described as follows:

Procedures to be followed for applying the following policy: Applying for Sick Leave

Sick leave works in a three-year cycle. An employee may take one day’s sick leave for every 26 days worked during the first six months of employment and thereafter an employee may take the number of days he/she normally works in six weeks during every three-year cycle.

Basically, an employee is entitled to 30 (if he/she works five days a week) or 36 (if he or she works six days a week) days’ paid sick leave for every three-year sick leave cycle.

The provisions for sick leave do not apply to workers who work less than 24 hours a month, or workers who receive compensation for an occupational injury or disease.

Medical Certificate or Sick Note: An employee may be requested to produce a valid medical certificate if he/she has been absent from work for more than two days in a row or more than twice in eight weeks. If the employee does not have a valid medical certificate, the employer does not have to pay the employee. The medical certificate must be issued and signed by a medical practitioner or any other person who is certified to diagnose and treat patients and who is registered with a professional council established by an Act of Parliament.

Although this is not in the Labour Legislation, the Ethical and Professional Rules of the Medical and Dental Professions Board of the Health Professions Council of South Africa provides the following instructions on the issuing of medical certificates or sick notes:

Rule 15: A practitioner shall only grant a certificate of illness if such certificate contains the following information, namely:

- The name, address and qualification of the practitioner.

- The name of the patient.

- The employment number of the patient (if applicable).

- The date and time of the examination.

- Whether the certificate is being issued as a result of personal observations by the practitioner during an examination, or as the result of information received from the patient and which is based on acceptable medical grounds.

- A description of the illness, disorder or malady in layman's terminology, with the informed consent of the patient: provided that if the patient is not prepared to give such consent, the medical practitioner or dentist shall merely specify that, in his or her opinion based on an examination of the patient, the patient is unfit to work (confidentiality issues need to be addressed in this regard).

- Whether the patient is totally indisposed for duty or whether the patient is able to perform less strenuous duties in the work situation.

- The exact period of recommended sick leave.

- The date of issuing of the certificate of illness.

- A clear indication of the identity of the practitioner who issued the certificate which shall be personally and originally signed by him or her next to his or her initials and surname in printed or block letters.

- If preprinted stationery is used, a practitioner shall delete words that are irrelevant.

- A practitioner shall issue a brief factual report to a patient where such a patient requires information concerning himself or herself.

Finance

The goal of the Finance Department includes basic accounting, cash flow, monitoring the availability of funds and implementing credit and collection policies.

Specific legislation pertaining to finance includes this department includes Public Finance Management Act of 1999.

A policy for finance may include the Investment of Money. Procedures to support this policy can be described as follows:

Procedures to be followed for applying the following policy: Investment and Cash Management Policy

In terms of MFMA section 13(2), each municipal council and the governing body shall adopt by resolution an investment policy regarding the investment of its monies not immediately required. An accounting officer has an obligation to ensure that cash resources are managed as efficiently and economically as possible. Competitive investment and effective cash management ensure both short term and long terms viability and sustainability of the municipality. Hence, it is critical for the municipality to have its own investment and cash management policy located within the local government framework. This policy should be read and understood against this background.

The primary and ultimate goal of the investment of funds is to earn the returns on investment principal, an amount invested whilst managing liquidity requirements and providing the highest return on investment at minimum risk, within the parameters of authorized instruments as per the MFMA.

Investments issue pertaining to municipal council approval.

In the event that an investment needs to be made, a quotation is required from the various financial institutions. In the case of telephonic quotations, the following information is required:

- The name of the person who gave the quotation

- The relevant terms and rates

- Other facts such as if interest is payable on a monthly basis or on a compound basis upon maturation.

Where payments to a financial institution in respect of investment are to be affected by cheque, The following procedures must be observed:

- The Accountant must complete a cheque requisition form and submit it to the Chief Financial Officer together with the supporting quotations for authorization.

- The municipal manager will then approve or submit it to the municipal council for approval depending on the term of such an investment.

- When the municipal manager has approved the investment, the chief financial officer and the delegate signatories are required to sign the cheque and submit it to the financial institution concerned.

All investment documents must be signed by two authorized cheque signatories.

The chief financial officer must ensure that a bank, insurance company or other financial institution, which at end of a financial year holds, or at any time during a financial year held, an investment for the municipality must;

- Within 30 days after the end of that financial year, inform the Auditor-general, in written form about all investment, including the opening and closing balances of such an investment(s) in that particular financial period.

- Promptly disclose information regarding the investment when so requested by the National Treasury or the Auditor-general.

- Promptly disclose information of any possible or actual change in the investment portfolio that could or will have adverse effects.

Internal Control Procedures

An investment register should be kept of all investments made. The following facts must be indicated:

- Name of the institution; Capital invested; Date invested; Interest rate and Maturity date.

Investment register and accounting records must be reconciled on monthly basis.

The investment register must be examined on a monthly basis by the Divisional Head Income, to identify interest falling due within the next month.

Interest, correctly calculated, must be received, together with any distributable capital. The chief financial officer or his/her delegated assignee must check that the interest is calculated correctly, in relation to sound universally accepted financial management practices.

Investment documents and certificates must be safeguarded in a fire-resistant safe, with dual custody.

The following document must be safeguarded:

- Fixed deposit letter or investment certificate

- Receipt for capital invested

- Copy of electronic transfer or cheque requisition

- Schedule of comparative investment figures

- Commission certificate indicating no commission was paid on the investment

- Interest rate quoted

All investment must be denominated in the Republic of South Africa rand (ZAR).

The Chief Financial Officer or his/her delegated assignee are responsible for ensuring that the invested funds have been invested with a financial institution/s that is or are in line with and approved by the Republic of South Africa: National Minister of Finance, Public Investors Commission or and with a rating of AA and endeavour to minimize risk exposure.

Public Relations

The goal of the Public Relations Department is to manage the spread of information between the specific organisation and the public. This department must persuade the public, investors, partners, employees and other stakeholders to view the integrity, accountability and image of the company in a positive and accepted manner.

Specific legislation pertaining to public relations includes the Protection of Personal Information Act (Act 4 of 2013). Procedures to support this policy can be described as follows:

Procedures to be followed for applying the following policy: Unfair dismissal

The Labour Relations Act (LRA), Act 66 of 1995 aims to promote economic development, social justice, labour peace and democracy in the workplace.

Depending on the industry you are working in, you will have to contact the CCMA or the respective bargaining council if there is one in your industry. For clarity on whether it should be the CCMA or a bargaining council, you may approach the CCMA directly.

People who would like to register disputes for conciliation at the CCMA need to complete LRA Form 7.11. These forms can be obtained free of charge from the offices of the CCMA or downloaded from the CCMA website www.ccma.org.za

The LRA form 7.11 consists of only 5 pages and is user friendly and easy to complete. The form also provides instructions on what steps to follow when referring to a dispute. Employees that need clarification on the completion of the form may contact the above-mentioned offices. It is important to note that there is a time frame involved, and employees need to complete this form within 30 days from the date when the dispute arose. These 30 days are calendar days and include weekends and public holidays. It excludes the day the dispute arose but include the last day (30th day).

If an employee fails to comply in referring the dispute within 30 days, he/she need to apply for a process called condonation. In applying for condonation, the employee will have to provide:

Reasons for lateness: The reasons why the matter was not referred within the prescribed 30 days.

Prospects of success: The employee should explain with good reasons why he/she believes that the dismissal is unfair.

Prejudice: (Reasons why the employee that he/she will be prejudiced.

General: Any other general related information with regards to the dispute.

The Commissioner will consider the above reasons when making a decision on whether or not to grant condonation. After completion of the LRA form, you need to make sure that you serve the notice to the other party.

Proof that a copy of this form has been served on the other party must be supplied by attaching:

- A copy of the registered slip from the post office.

- A copy of a signed receipt is hand-delivered.

- A signed statement confirming service by the person delivering the form.

- A copy of a tax confirmation form.

- Any other satisfactory proof of service.